Juliana Kaplan

April 2, 2024

Just because someone makes six figures doesn't mean they have a high net worth — or vice versa.

Instead, there's a subset of high earners who aspire to accrue that nest egg but are still plugging away. Unlike many older Americans with a higher net worth, these workers are called HENRYs — high earners, not rich yet, a term first coined over 20 years ago by Fortune's Shawn Tully. They might someday own the assets to make them millionaires, but for now, they're just raking in plump paychecks.

So who are the HENRYs?

FatCamera/Getty Images

To break down the demographics of America's HENRYs, we used the 2022 Survey of Consumer Finances, released this year, to analyze Americans who earned $200,000 or more a year but had net worths under $1 million.

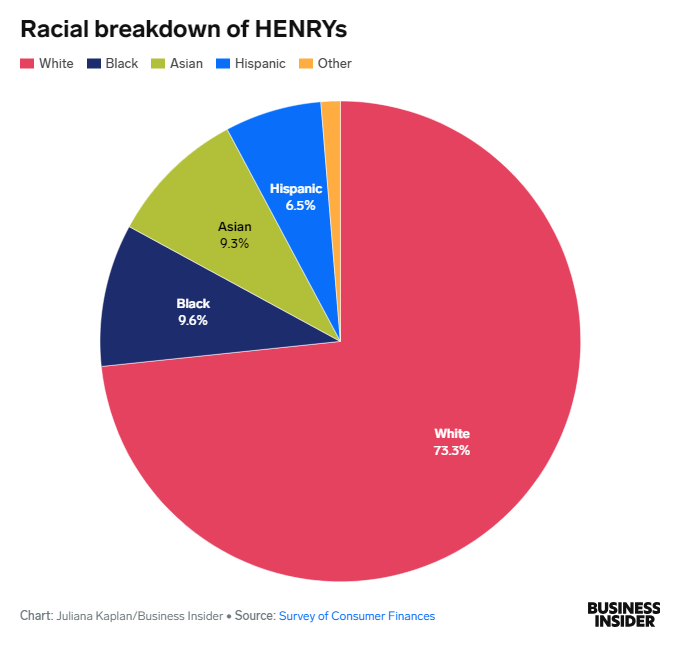

So who are these stratified HENRYs? They're a little older than the wider HENRY base, primarily white, and most likely in a salaried role.

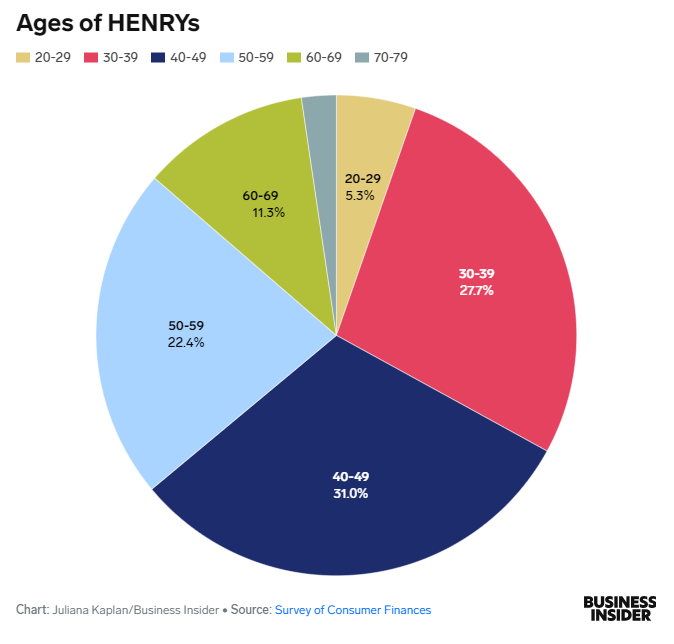

Broadly, we know that they're typically millennials or younger Gen Xers. Most HENRYs are ages 40 to 49, though 5.3% are 20 to 29. Nearly 28% are 30 to 39, and over one-fifth are 50 to 59. The average age of a HENRY is about 46.

HENRYs are also overwhelmingly coupled up.

Just over 90% of HENRYs are married. As Business Insider's Noah Sheidlower previously reported, many HENRYs are likely to be DINKs — meaning that they're in double-income households with no kids.

For some couples, being DINKS has meant the ability and freedom to travel, save, and prepare for an early retirement. Our analysis of this group of HENRYs found that about 31% were married with no kids, a higher rate than the 20% of American adults overall who researchers estimate could be opting to go child-free. Just under 60% of HENRYs are married with children.

HENRYs all hold financial assets; they also overwhelmingly have checking accounts, and the vast majority have cars and houses.

Many HENRYs also have some debt, which makes sense since many have mortgages. Unlike their millionaire or billionaire counterparts who derive most of their wealth from holdings, HENRYs are likely still paying off some debts.

HENRYs who are indebted hold an average of $319,170 in debt; just over three-quarters of HENRYs have mortgage and home-equity loans, and those loans have an average balance of about $312,185.

Meanwhile, about 43% of HENRYs have educational loans; those are, on average, about $74,864.

Right now, Americans are, on the whole, having somewhat of a credit crisis. Credit-card balances keep reaching record highs, and Fortune found that American cardholders had, on average, $5,733 credit-card balances. HENRYs are carrying nearly twice that much. Like other consumers, HENRYs carry some credit-card debt, and just under half have credit-card balances.

Even so, HENRYs tend to earn their money the same way as most Americans: They work a job that earns wages. While wages make up the majority of HENRYs' incomes, a good chunk does get income from capital gains and businesses they own.

That's a key distinction between the HENRYs and those who might be considered ultrawealthy. Billionaires tend to get most of their compensation through capital gains — the money they make from selling off assets like stocks — which are taxed at a lower rate than a normal paycheck.

But as HENRYs pay off their debts and continue to accrue real estate or stocks, they might make the jump from high-earning to asset-rich — just not quite yet.

Subscribe to Business Insider's Financial Insights Newsletter

This Business Insider article was legally licensed by AdvisorStream