by Liz Knueven and Sophia Acevedo

April 3, 2024

- The average American family has a $1.063 million net worth, according to Federal Reserve data.

- But the median net worth is $192,900.

- Data shows that net worth varies across age, race, location, and education level.

The average net worth of American families is over $1.063 million, according to the most recent data from the Federal Reserve's 2022 Survey of Consumer Finances. The Federal Reserve conducts the survey for calculating average American net worth every three years; the most recent report was released in October 2023.

Between 2019 and 2022, the average American family's net worth increased by 23%.

iStock image

While the average net worth is upward of $1 million, the median net worth tells a very different story. Calculated this way, the typical American family has a net worth of $192,900. The median, or middle value in a set of numbers, is less sensitive to outliers, so may be a more accurate representation of a typical family. The median shows a very different reality for Americans, and we've included both numbers in this look at American families' finances.

What is net worth?

Net worth: Definition and importance

Net worth is the total value of assets you own, minus any liabilities or debts.

In this study, the Federal Reserve included several categories of assets, including:

- Bank accounts, including checking, savings, money market accounts, cash accounts at brokerages, prepaid debit cards, and call accounts

- CDs, government bonds, and savings bonds

- Health savings accounts

- Investment accounts including 529 college savings plans and individual taxable investment accounts

- Retirement accounts, including IRAs, 401(k)s and 403(b)s

- Cash value life insurance policies and annuities with equity

- Vehicles including cars, RVs, motorcycles, boats, and helicopters

- Real estate, including residential homes

In calculating net worth, liabilities or debts are subtracted from the value of assets amount. In this survey, debts included:

- Mortgages

- Home equity lines of credit or home equity loans

- Credit card balances

- Installment loans, including auto loans and student loans

How to calculate your net worth

To calculate your net worth, follow these three steps:

- Determine the total all your liquid assets, like cash and savings, as well as illiquid assets, or money that can't be as easily converted to cash, like land or a vehicle.

- Determine the total of your liabilities, including debt and outstanding payments, like student loans and medical bills.

- Subtract your total liabilities from your total assets.

The resulting figure is your net worth.

Average American net worth

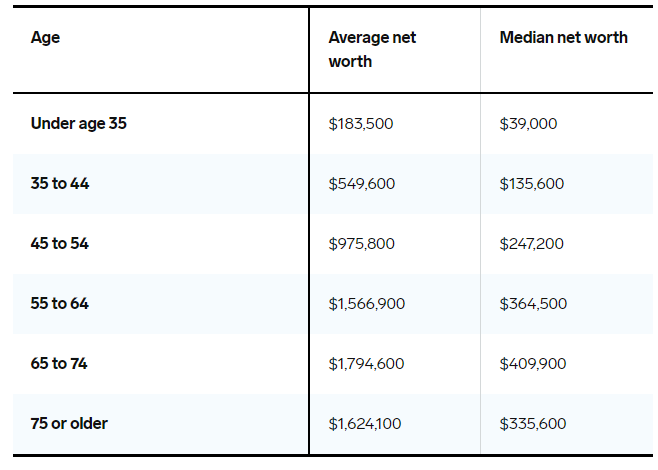

Average net worth by age

The impact of age on net worth is notable. People tend to build up worth in some assets with time. Retirement savings, for instance, grow through compound interest, where interest earns more interest on itself. Home equity, or the value of your home minus any mortgage debt, also tends to increase with time.

Here's the typical American's net worth by age, according to Federal Reserve data:

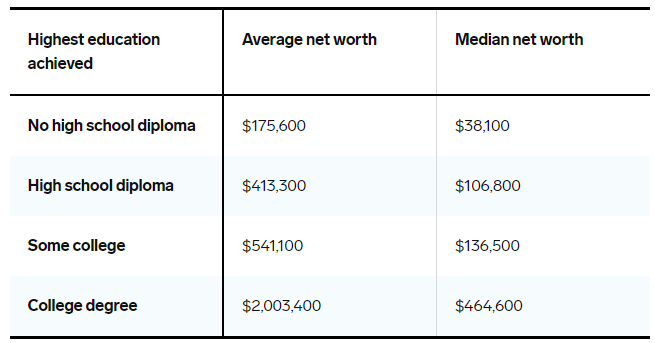

Average net worth by education level

As the head of household's level of education increases, the average net worth increases as well. The average college graduate has a net worth more than 11 times that of the typical American without a high school diploma, and about four times greater than someone who didn't finish college.

Here's how educational achievements play into Americans' average and median net worth:

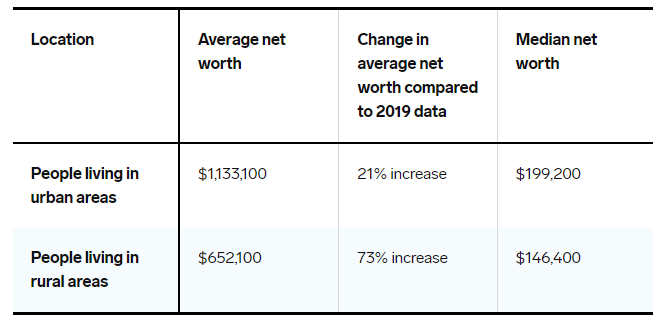

Average net worth by location

Where you live tends to play a major role in your net worth. While costs of living in America's cities tend to be higher than the costs outside of them, the typical American living in a city tends to have a higher net worth than people living in rural areas.

Average data shows that the typical American in an urban area has over 1.7 times the net worth of a rural American. In part, higher real estate values in cities could contribute to urban America's higher net worth.

Data from the same Federal Reserve study indicates that families living in urban areas saw incomes increase 21% on average between 2019 and 2022, while Americans outside of urban areas saw a 73% increase during the same time period.

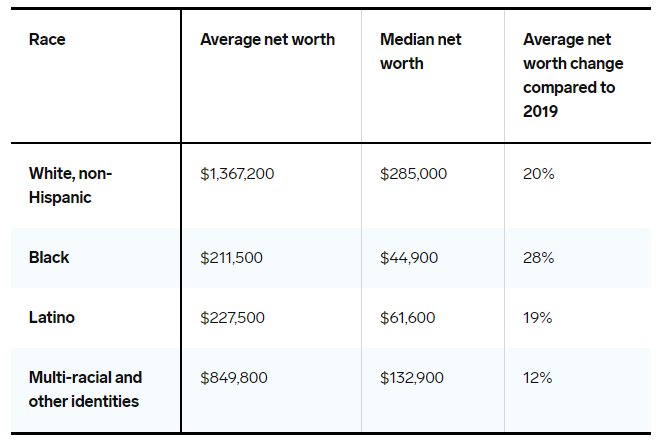

Average net worth by race

The racial wealth gap is apparent in America's average net worth. The average Black family still has a net much smaller than the average white family, based on the most recent 2022 data.

Here's how the average net worth changes by race in America:

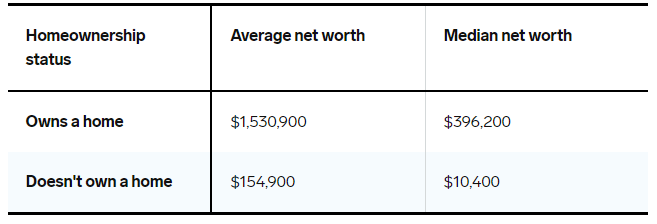

Average net worth by homeownership status

According to data from the Federal Reserve, the average homeowner has a net worth of over 9.8 times the net worth of the typical person who doesn't own a home.

Factors influencing net worth

Income levels

A household's income can significantly influence people's net worth. According to Pew Research, the typical upper-income household has a net worth that's 33 times higher than the typical lower-income household.

This doesn't necessarily mean that someone with a high salary will always have a higher net worth than someone with a lower salary, though. Net worth depends on how you use your money to accumulate assets and manage liabilities. Someone with a lower salary can still grow their net worth effectively by managing their expenses and contributing regularly to their savings and investments.

Savings and investment choices

Savings and investing over time can also affect your net worth. Net worth factors in the balance of your savings and investment accounts. It also includes the value of significant purchases you've made, like expensive jewelry, clothes, and furniture.

Real estate, in particular, is a big factor in net worth. Even with a mortgage, owning a home can still contribute to net worth. Federal Reserve data also shows that homeowners have a higher net worth than those who don't own a home.

Debt and liabilities

You need to subtract debt and liabilities from assets to determine your net worth. If you have significant debt, you could end up with a negative net worth if you're liabilities exceed your assets.

Managing your debt and liabilities can ensure you maintain a positive net worth.

How to grow your net worth

The best way to build wealth is to play the long game: Decide on your goals now, and start working toward them with small steps along the way. Here are three places to start:

Maximize your retirement savings

Whether you save and invest for retirement through your office's 401(k) or have a solo 401(k) if you're self-employed, starting to save for retirement is one of the most important ways to build your net worth.

There are numerous investment strategies for enhancing personal net worth. If you qualify based on income, a Roth IRA could help you save beyond your 401(k) plan and let money grow tax-free. A traditional IRA is available to almost anyone at any income level, and can help you lower your tax bill now instead of later.

Start investing now

Whether you want to start building wealth through an investment app or just want to invest automatically without too much management, investing for the long term is another way to grow your net worth.

Opening a brokerage account is the first place to start. There are different types of brokerage accounts to fit your goal, some more specific than others. If your goal is to pay for your child's college someday, opening a 529 plan might be the right fit for your investing. For people who have already hit the maximum limits on retirement investment accounts, putting your investments into an individual brokerage account might be right for you.

Get smart with your savings

Attaining big assets, like real estate, that build your net worth usually involves saving some cash up front. Whether you want to save for the down payment on a house, or build an emergency fund, having the right savings account is critical.

If your savings account is earning .01% interest, it's time to open one of the best high-yield savings accounts to help your money earn more. A high-yield savings account could help you earn multiple times more interest each month, and help you reach your goals quicker.

Subscribe to Business Insider's Financial Insights Newsletter

This Business Insider article was legally licensed by AdvisorStream