By Gunjan Banerji

April 29, 2024

Financial adviser Matthew Wilson recently got a frantic email: A client wanted to dump their stockholdings as soon as possible.

The reason? Stocks had staged a big run-up in recent months, and the client was worried that the market was about to get rocky heading into the presidential election in November. During an in-person meeting, Wilson said he was able to convince them to stay in the market.

“Vote with your vote, don’t vote with a trade,” said Wilson, a managing director at Roseville Wealth Management Group.

iStock image

Around the country, investors are getting jittery about the coming rematch between President Biden and former President Donald Trump.

Many are peppering their financial advisers with questions about what the contest will mean for their portfolios. On Wall Street, strategists have been trying to sketch out the implications of a blue or red win on stocks, interest rates and oil prices.

The U.S. presidential and congressional elections this fall “stand to be among the most consequential in a generation,” wrote a team at BNP Paribas led by its chief U.S. economist, Carl Riccadonna.

Fueling the nerves are the dramatically different decisions Biden or Trump could make on everything from immigration to who leads the Federal Reserve—and even how the central bank is run. The next president would also steer the U.S. through a time of heightened global tensions, with escalating conflicts in the Middle East and the continuing war between Russia and Ukraine.

One point of focus for investors: the Trump administration’s tax cuts, which will lapse after 2025.

Already, the government’s spending and the accompanying deluge of Treasury issuance has been making investors anxious. The BNP team said a Republican sweep of the White House and Congress would likely lead to an extension of tax cuts for individuals, and a wider deficit. Of course, any implications for the deficit would be shaped by the mix of spending and cuts that lawmakers agree on. Biden, for example, has said he would extend some Trump-era tax cuts.

The yield on the 10-year Treasury note recently hovered at 4.668%, up sharply for the year, in part because of a wave of bond issuance and stickier-than-expected inflation.

Even after a rough patch for markets in April, traders appear more anxious about this fall’s election than they are about the coming weeks.

In the derivatives market, traders have been paying more to protect against a stock-market decline around November, a sign of heightened fear about the election, data from FactSet tied to the Cboe Volatility Index show.

In a 62-page report this year, BNP Paribas strategists and economists laid out multiple scenarios tied to how the election would shape power in the White House and Congress, as well as how leaders might influence everything from fiscal policy to clean energy and tariffs on China and Mexico.

During Trump’s presidency, for example, the U.S. dollar swung wildly against the Mexican peso based on Trump’s tweets about tariffs on the country.

Still, investors might be fooling themselves if they think they can predict the path of any asset around the election.

In 2016, some investors feared a Trump win would jolt markets. It did—momentarily. Stocks swooned overnight while election results trickled in, before staging a U-turn the following day and kicking off one of the biggest stock rallies in the wake of a presidential election. Investors seemed to love Trump’s tax cuts and promise of deregulation.

In 2020, some investors worried that a murky election result could stoke stock-market mayhem for months. The S&P 500 ended up soaring around 11% from Election Day in November through the end of the year.

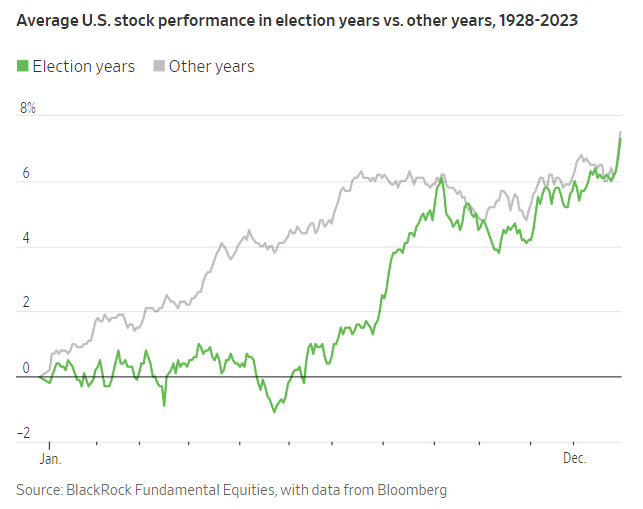

Stock volatility isn’t unusual around an election. But once the uncertainty passes, stocks typically rally, according to data from BlackRock Fundamental Equities. There also isn’t much of a difference between average stock performance during years in which an election is held and ones without a contest.

David Sadkin, a partner at Bel Air Investment Advisors, said he has been asked about the election at almost every meeting he takes with his wealthy clients. He said both parties have shown an inclination to spend big, leading to widening U.S. deficits.

Treasury issuance has surged, spanning both Trump and Biden’s presidencies. It’s one reason he cautions investors against making a big bet around the outcome.

“The impact is impossible to predict,” Sadkin said.

Write to Gunjan Banerji at gunjan.banerji@wsj.com

Dow Jones & Company, Inc.