By Telis Demos

July 11, 2024

Beryl has set records as the strongest Atlantic hurricane to form this early in the season. But it might not be powerful enough to change the direction of catastrophe insurance prices.

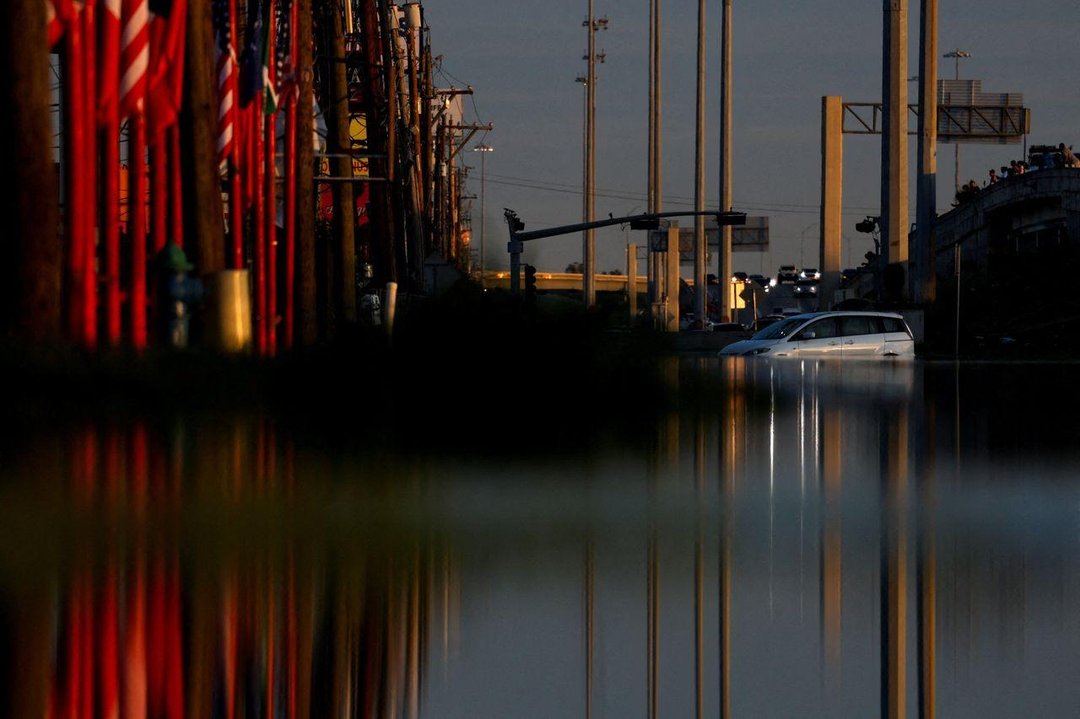

A car submerged in floodwaters in Houston in the aftermath of Hurricane Beryl. PHOTO: DANIEL BECERRIL/REUTERS

With a path taking it through the Houston region, Beryl was the earliest hurricane to make landfall in Texas since 1986, according to Gallagher Re. It comes on the heels of scientists’ predictions that high sea-surface temperatures could lead to a very active year of storm formation in the Atlantic.

However, the impact of an early-season loss on the insurance market might still be limited. The market appears to be well-balanced, thanks in part to new capital that has recently come in to help provide more coverage.

Last year saw a surge in what it costs for insurers to protect themselves against the risk of big losses stemming from major disasters like hurricanes or earthquakes. That was a boon for the so-called reinsurers that provide this kind of coverage. Ratings firm AM Best noted in a report that the recent “hard market” in reinsurance has generated “risk-adjusted returns not seen since 1993.”

Those returns have led to an influx of capital for reinsurance. Notably, there has been a jump in the issuance of catastrophe bonds, which pay an attractive interest rate but can lose their principal in the event of a certain kind of storm or magnitude of loss. Reinsurers themselves have also built up more capital on their own. At the same time, there has been increasing coverage needs from primary insurers facing inflation of claims costs.

The upshot is that supply and demand are apparently in balance. Guy Carpenter’s preliminary 2024 index for U.S. property catastrophe reinsurance pricing was flat year over year in terms of dollars spent and down slightly when adjusted for change in the amount of risk being covered.

“Over the past couple of years, reinsurance rates have gone up significantly, and in many cases they are already several multiples of the expected losses,” says Karen Clark, co-founder and chief executive of Karen Clark & Co., which builds models for insurers to understand and manage catastrophe, climate and weather risk.

Cat bonds often cover some of the most extreme risks. As warnings of an active hurricane season came in earlier this year, combined with strong bond supply, the market has evolved somewhat. The weighted-average margin on newly issued bonds—a measure of what investors can earn on the bonds in excess of the expected loss—has risen since earlier this year, according to Gallagher Re’s recent tracking. It is lower than peak levels last year, though also still above 2022 levels.

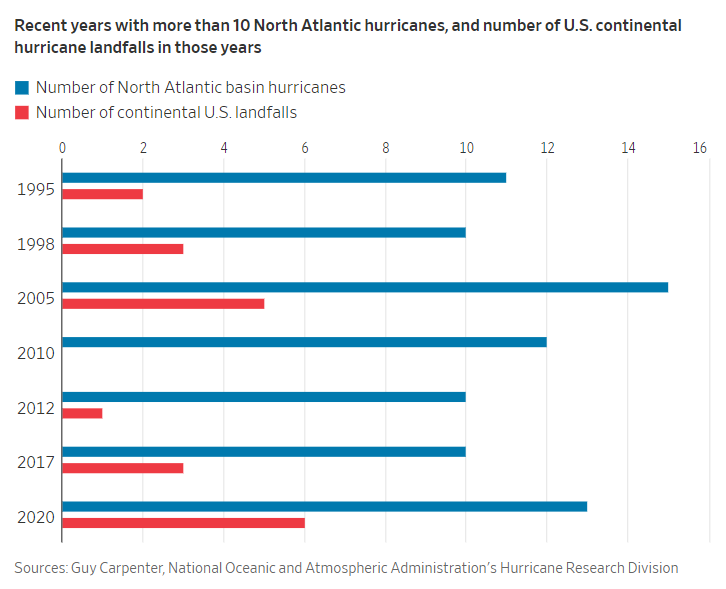

But an active storm-formation season doesn’t necessarily imply one that will trigger the degree of losses that can ripple through the reinsurance ecosystem, which depends on things like storms’ location when making landfall.

“While perhaps a very rough indicator of directionality, hurricane activity in the basin is not a reliable predictor of seasonal insured loss,” Guy Carpenter wrote in an outlook for the 2024 North Atlantic hurricane season. The firm’s review of nine seasons that produced 10 or more hurricanes in the North Atlantic basin found that estimated insured losses in those years ranged from under $1 billion to over $100 billion.

Of course, a light season for formation or damaging landfalls also might not imply that pricing is too high. Notably, the season in which Hurricane Andrew hit in 1992 was overall rather inactive, according to Clark.

So Beryl’s early landing doesn’t necessarily mean that reinsurance pricing will continue to climb, ultimately squeezing consumers and businesses and contributing further to inflation. But avoiding the very worst potential outcomes this year doesn’t mean that pricing should come down soon, either.

Write to Telis Demos at Telis.Demos@wsj.com

Dow Jones & Company, Inc.