By John Authers

July 22, 2024

John Authers is a senior editor for markets and Bloomberg Opinion columnist. A former chief markets commentator at the Financial Times, he is author of “The Fearful Rise of Markets.”

Insurance, health care and pension funds are struggling with political institutions in a world that’s living and working longer.

Letting go.Photographer: Michael Nagle/Bloomberg

A Brush With Mortality

Aging and mortality apply to all of us. That is among many reasons why the crisis around Joe Biden, who has now made the painful decision not to run for the presidency, has gripped the world. The difficulty that we all have in coping with those issues, or even addressing them, is central to the dreadful mess that has become the US election.

We’ve gotten very good at dealing with the risk of dying too young. Even in the world’s poorest countries, life expectancy is surging. Medicine has improved, as has sanitation, and public health initiatives have curbed smoking. Life insurance can cheaply and easily cover the financial risks of an untimely end.

Biden’s abdication rams home, however, that we’re no good at dealing with the risks created by greater longevity. We don’t have the institutions, medical techniques, financial products or — it now appears — political structures to deal with the problems that can come with longer lives. The evolution has been slow and imperfect. Companies that started out to provide life insurance, for example, have tried to adapt to offering pensions instead.

That has been difficult. Funding the guarantees made to pensioners when far fewer of them seemed likely to make it to advanced old age is proving agonizingly difficult, as a series of flash points around the world should make clear. The implosion of British Prime Minister Liz Truss in 2022 as a sharp rise in bond yields brought pension funds to their knees as they resorted to desperate financial engineering to meet their obligations showed a problem that lingers. So did the breakdown in civil order in Chile in 2019, as the populace rebelled at the disappointing returns from a much-admired pension system installed in the 1970s. In France, President Emmanuel Macron’s decision to raise the retirement age from 62 to 64 has sparked social discontent. The main attempt to deal with this issue has often been to make pensioners, rather than providers, take market risks. That brings its own dangers.

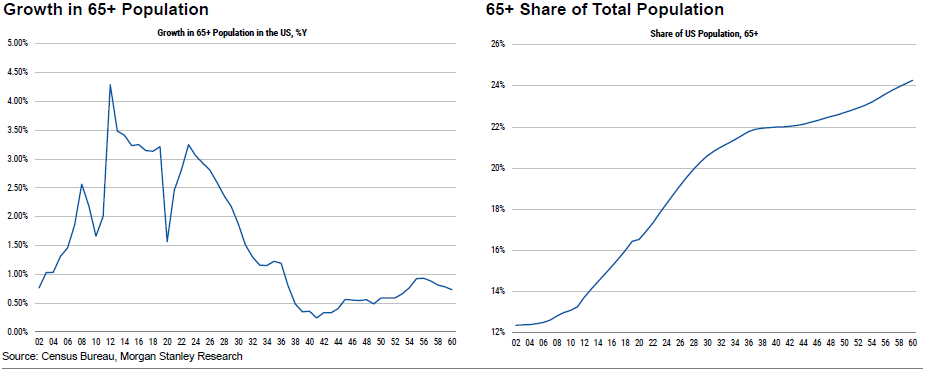

The problem will not go away. The proportion of over-65s in the US is set to rise. These charts are from a Morgan Stanley report titled “Longevity in the US”:

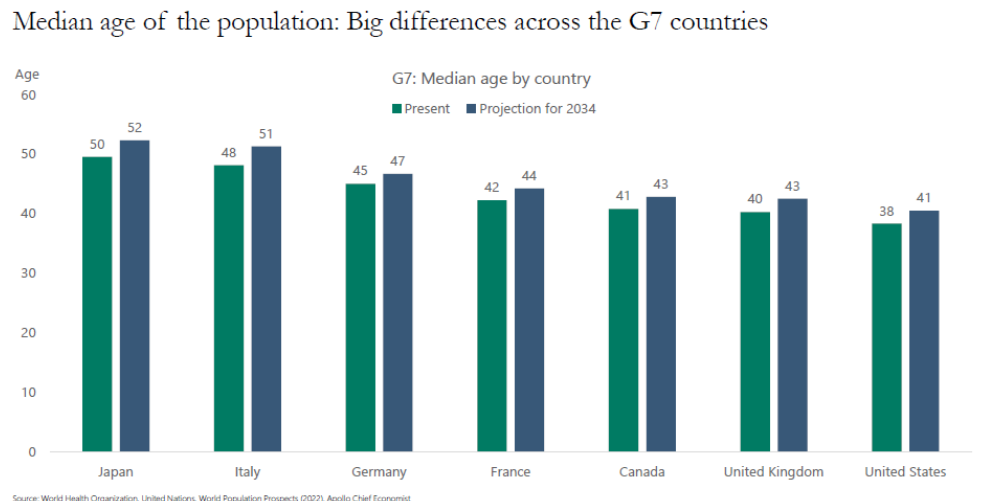

And while the focus at present is on America, the country is younger than its counterparts among the wealthiest nations. The median age is still below 40. In Japan, it has reached 50, with Italy projected to follow by the end of this decade. The following chart comes from Torsten Slok, chief economists of Apollo Group:

Can societies possibly continue to make generous guarantees to the elderly when they now comprise such a large share of the population? Retreating from this is politically so difficult that it’s unlikely to happen until long after crisis has hit. That in turn implies deeper issues of intergenerational injustice as younger people work increasingly to support the elderly. None of these issues is new; by their nature, demographic problems can be seen coming from a long way away, as I wrote elsewhere back in 2016. But it’s also true that issues so long term can always be delayed for another day.

There is a growing body of research on ways for investors to profit from longevity, particularly through the growth in long-term care. However, the performance of Bloomberg’s index of the real-estate investment trusts that hold nursing homes and long-term care facilities shows that investors aren’t yet convinced. It’s actually fallen over the past decade:

It’s still far cheaper for the very elderly to stay in their homes (which exacerbates the problem the younger generations have in finding housing). Solving this problem will be crucial.

Then there is the issue of public service. The elderly need to retake driving tests and pay more for insurance, but there are minimal guidelines for when people in powerful positions should stand down. Sumner Redstone famously stayed on at the head of Viacom past the age of 90, declaring “I’m not going to die” (he passed at age 97). US political institutions seem to make the same assumption. There is a minimum age to be president, 35, but no maximum. Nor is there for members of Congress or Supreme Court justices. The 25th Amendment added in 1967 allows for the replacement of an incapacitated president — in corporate terms, removed by the board — but remains untested.

Mandatory retirement ages, maybe 80, would be a solution but difficult to achieve for a good reason. The rising number of older people who are still able to perform in stressful jobs will object, strenuously. And ultimately, there is a natural human respect for the elderly that will confront any indiscriminate attempt at reform.

Dignity in old age matters. If Biden’s historic but necessary decision to stand down does nothing else, may it at last force us all to confront the problem that goes far beyond just him.

Markets Hate Uncertainty…

Markets’ vaunted hatred of uncertainty is one of the most irritating clichés in the book. And in the last week, a president has been bloodied by an assassin’s bullet for the first time since 1981, while another has opted not to contest a second term for the first time since 1968. That sounds momentous. But it’s not clear that there’s much uncertainty for markets to hate.

We now know that Biden will not be the Democrats’ candidate, while Kamala Harris is very likely to get the nod. She is a very different person from Biden, but would be the continuity candidate with no obvious divergence on any key issue. The chances of Trump losing are slightly higher than they were, as she lacks Biden’s critical age disadvantage, but not by much. The initial response of betting markets was to take Trump’s probability of victory back down to 61%, almost exactly where it was before a gunman fired at him:

As it stands, a Trump return to the White House remains the most likely outcome, as it has looked all year. The same is true of a Republican majority in the Senate, although Biden’s decision might help a few Democratic incumbents hang on. It’s probably fair to say that the chances of a Red Wave sweep of the presidency and both houses of Congress have diminished, but not by much.

Mark Hatfield of InfraCap made the point as follows:

We expect a muted stock market reaction from President Biden’s resignation from the presidential race as it was widely expected. The fact that Biden endorsed Kamala Harris reduces uncertainty. There may be a small unwinding of the Trump trade on Monday as Vice President Harris is perceived to have a slightly better chance of winning, with CBS News publishing a poll Friday that showed Harris trailing 51/48 vs. Biden at 52/48.

Trump in Michigan last weekend.Photographer: Emily Elconin/Bloomberg

Looking a few more weeks into the future, Marko Papic of BCA Research comments that replacing the sitting president at the head of the ticket this late in the race is a sign of panic: “It is — to put it in terms investors should understand — the equivalent of the Fed panic-cutting 100 basis points.” As such, it should at least prompt much more attention for the Democrats, and give them a chance to transform the debate. Sectors seen to benefit from Democratic control could enjoy a bounce. To quote Larry McDonald of Bear Traps Report:

Markets are starting to figure out that the investing landscape is entirely different if a Trump White House comes with control of BOTH the House and Senate. Clearly, the Trump trades are richly priced today relative to a bounce the Dems will likely have coming out of the convention.

Policy under Trump would be more predictable, and markets more comfortable, if there was some check on him from Congress. A really big dash for growth would also be harder to pass.

But what exactly are the Trump trades? His agenda of cutting corporate taxes and deregulating should be good for stocks, and his political ascent has helped them over the last year. That said, the S&P 500 had its worst week in months following the attempted assassination that seemed to improve his chances, so the relationship isn’t linear. A look at how major indexes have done since two key political developments — the debate June 27 and the shooting July 13 — shows that beyond the banking sector, which has prospered, there has been no clear or consistent response to Trump’s growing chance of victory.

That’s reasonable enough, because there are other factors in play, which are generally more immediate. Meanwhile, his fiscally expansive economic agenda, in combination with promised extra tariffs, should be bad for bonds, and so far hasn’t been. Ten-year Treasury yields are lower than before the debate, while the yield curve has steepened, but not by much.

Defining a Trump trade in foreign exchange is particularly difficult as he explicitly wants a weaker dollar, while the market consensus at present is that he would mean higher yields, greater uncertainty, and hence a stronger dollar. If there’s a lack of urgency about pricing in the risks of Trump 2.0, it’s because the Federal Reserve’s monetary policy is considered far more important. A likely rate cut in September drowns out potential fiscal expansions starting next year.

Lindsay James, investment strategist at Quilter Investors in London, commented that expectations of rate cuts would “remain the driving force for market returns, rather than a noisy election campaign.” She added: “Trump is favored but if Kamala Harris, or another nominee, makes inroads then the recent rotation may lose legs and that volatility could take over.”

The chances of a Republican clean sweep in November have just reduced a bit, but it remains more likely than anything else. To date, the market has taken on board the positive implications for stocks, but not the negative implications for bonds. For all the drama, that’s unlikely to change.

—Reporting by Richard Abbey

Survival Tips

A reading recommendation: I’m currently deep in What It Takes by Richard Ben Cramer. It’s a political book like none I’ve ever read. It tells the story of the 1988 election, in which George H.W. Bush triumphed over Michael Dukakis, but does so by constantly asking what it is that drives people to want to be president enough to run, and to believe sincerely that they should have the job. To do this, he delved deep into the biographies of six of the runners that year, adding Bob Dole, Richard Gephardt, Gary Hart and — fascinatingly in the current moment — Joe Biden. The whole thing is a doorstopper, written in gloriously sweeping prose that’s reminiscent of Marcel Proust. Or Salman Rushdie. The portrait of the young Biden brings out many aspects of the man that are no longer part of his biography, and gave plenty of hints, in a book published more than three decades ago, that he was not the kind of man to stand down. The whole thing is intoxicating and is leaving me with much greater respect for those who put themselves forward for office. It’s great for a long read. Enjoy the week everyone, whatever surprises it holds in store.

© 2025 Bloomberg L.P.