Aug. 8, 2024

A weak jobs report in America has raised fears that the world’s largest economy is heading for recession. America’s stockmarkets have tumbled, with fear spreading to other countries. Japan’s Topix index is 15% off its recent high; Germany’s main index is down by 7%. When America sneezes, everywhere catches a cold.

iStock-840975092

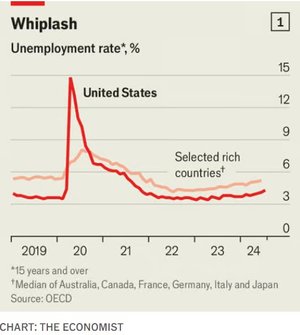

But a look at the latest data suggests that the global economy is not in danger, and that the market panic may be misplaced. Turn first to the labour market. America’s unemployment rate has risen from a low of 3.4% in April 2023 to 4.3% in July. Indeed, history suggests that an increase of this size tends to accompany a drop in economic output—leading, in turn, to a further rise in unemployment, bankruptcies and falling incomes.

This cycle may be different, though, as labour markets in other parts of the rich world suggest. For months unemployment has been slowly rising almost everywhere (see chart 1). Germany’s jobless rate has increased from a recent low of 2.9% to 3.4% today. Britain’s has risen from 3.6% to 4.4%, while Australia’s has gone from 3.5% to 4.1%. Some of this uptick has a common cause: a loosening of the extraordinarily tight labour market at the end of the covid-19 pandemic. Not long ago employers, struggling with labour shortages and sky-high demand, would take on practically anybody they could. Now, with everything more settled, they can be discerning.

On top of this, unemployment is rising in part because of changes to the rich world’s labour force. The OECD’s working-age labour-force-participation rate recently hit an all-time high. Those who had once been on the economic sidelines are now actively looking for work—something which, in the short run at least, can raise the unemployment rate. These people have reason to think they will soon find a post. Job growth remains pretty strong. Over the past quarter employment has risen by 0.8% in Australia and 0.6% in Canada. Although Japanese employment fell by 0.03%, this is the exception in the rich world. It is also hard to square supposed labour-market weakness with wage growth that, across advanced economies, easily exceeds the rate of inflation.

If the story about jobs is reasonably subtle, the story about output is less so. Our judgment, from looking at a range of data, is that there is not much evidence of a slowdown. In a typical recession company profits plunge, but for now firms across the rich world are doing well. Research by Deutsche Bank suggests that in the first quarter of this year global corporate-earnings growth reached its highest level in seven quarters. The strong performance appears to have continued in the second quarter. American companies’ earnings look set to have grown by more than 10% year on year. On August 6th Uber, a ride-hailing app, reported good results. A healthy share of European companies are beating analysts’ expectations for profits. In South Korea second-quarter earnings were better than expected.

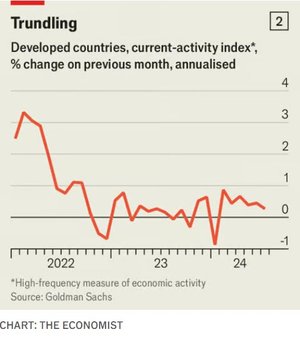

The economy at large offers a similar story. A weekly tracker of American economic activity, produced by the Federal Reserve Bank of Dallas, shows little sign of weakness. A global composite “purchasing managers’ index” that tracks economic conditions remains strong. Although the rate of expansion slowed in July, it remained among the best registered over the past year. A “current-activity indicator” produced by Goldman Sachs, a bank, gives another reason for optimism. Published at a high frequency and compiled from a range of sources, it provides a hint of where GDP across the rich world is going. The indicator, if anything, looks slightly stronger than it did for most of last year (see chart 2). Some economies are struggling with weak growth, including Austria and France. But they have looked sickly for at least a year—and the situation is a lot better than it was a few months ago.

The inflation picture is improving as well. After peaking at 10% in late 2022, inflation in the median OECD country has steadily fallen. In June median prices across the bloc rose by 2.6% year on year—close to central banks’ targets of 2%. About a quarter of OECD countries have now reduced inflation to that level or below. Annual inflation in Italy is less than 1%, while consumer-price growth in France and Germany is pretty much bang on target. It is ironic that concerns about recession have spread just as the rich world appears set to pull off a “soft landing”, in which central banks bring down inflation to target without causing much economic damage.

Worries about the economy can, in time, become self-fulfilling. As stockmarkets tumble, households might start to fret about the future or feel poorer, leading them to pull back on spending. Skittish companies might also cancel their investment plans. Inflation is not yet defeated, even if it has come down, and with commodity prices volatile it could increase once again. High interest rates continue to bite. Yet, for now, the global economy remains in decent health. ■