By Anne Tergesen

July 1, 2024

New hires are putting more of each paycheck into their 401(k). Not necessarily by choice.

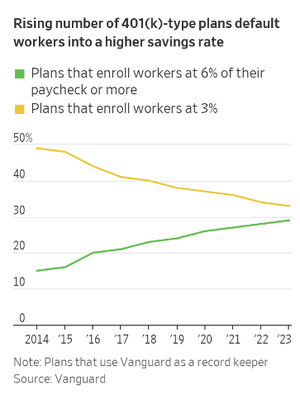

Nearly a third of companies that use automatic 401(k) enrollment now start workers saving at 6% of their salaries or higher, about double the share of organizations that did so a decade ago, according to Vanguard Group.

Kelly Mooney Photography

A default 6% contribution rate was once considered too onerous for younger workers and too paternalistic by those who favor leaving decisions to individuals.

“Initially, many companies defaulted people into the 401(k) at 2% or 3% of pay and that’s where many stayed,” said Dave Stinnett, head of strategic retirement consulting at Vanguard. “Now, companies are trying to get workers into the plan and saving as aggressively as possible.”

The share of companies that auto-enroll workers at a 3% contribution rate has fallen to 33%. It was 56% in 2007.

Higher savings rates help ensure people take greater advantage of matching employer contributions—free money workers often leave on the table, companies say. It also boosts employees’ total savings rates closer to the 12% to 15% of annual income financial advisers often recommend for a secure retirement.

Auto-enroll boosts savings

Automatic enrollment has helped make the 401(k) more effective, especially for millennial and Gen Z workers, a large share of whom have been opted in from day one.

About 60% of companies automatically enroll new hires, bringing 401(k) participation rates to 82% of eligible workers, up from 66% in 2007, according to Vanguard, which administers 401(k)-type accounts for nearly five million people.

Last year, the average employee with a 401(k) account at Vanguard saved 11.7% of pay, including matching contributions, an all-time high.

The jump to 6% automatic savings is a big reason for the rise in those savings rates.

People tend to take the path of least resistance when it comes to their finances, behavior that nudging techniques such as automatic enrollment capitalize on. Few people opt out.

Participants in plans with automatic enrollment saved 12.7% in 2023, on average. In 401(k) plans that require workers to sign up, savings rates averaged 10.3% last year.

Many plans further boost savings rates by automatically increasing contributions, typically by 1 percentage point a year until reaching around 10% of pay.

Starting too low

Companies originally gravitated toward auto-enrolling at 3% in part because of concern that a higher percentage might cause workers to opt out or might generate more costly employer matching contributions, said Mark Iwry, a former Treasury Department official who oversaw national retirement policy.

A 2007 study by researchers at institutions including Harvard University found that workers who were put into a 401(k) plan at 6% by default didn’t opt out in significantly greater numbers than those put in at 3%.

Still, having a higher default contribution might result in some workers taking on debt to make ends meet, studies have found.

Companies nudge harder

Workers didn’t blink when Verizon Communications doubled the starting savings rate for new hires to 6% in 2022, said Kevin Cammarata, vice president of benefits. Opt-out rates remained roughly the same as before.

Verizon wanted to help more employees take advantage of the company’s match of 100% of employee contributions up to 6% of pay, Cammarata said.

When the default savings rate was 3%, about 15% of participants didn’t increase their savings percentage.

“It was good we got them into the plan, but they were not optimizing the match,” said Cammarata.

Today 91% of the Verizon plan’s 68,000 participants are saving 6% or more, and receive the full match, up from 78% in 2020, before the switch, he said.

Some companies have even bigger defaults. Boston Consulting Group automatically enrolls eligible new hires at 10% of pay, an arrangement in place since around 2010.

When combined with the company contribution of 5% or more, depending on factors including tenure, the 10% automatic enrollment rate helps participants reach the 15% savings rate advisers recommend, said chief human resources officer Susan Grimbilas.

Smaller companies have also embraced the strategy. Portland, Ore., consulting firm Rose City Philanthropy has been automatically enrolling new hires at 6% of pay since starting a 401(k) plan in 2020. Its four employees are all saving 6% or more, said senior partner Jeri Alcock.

Alcock said she spent years in the nonprofit world and was “stunned to see people spend their lives helping other people and face retirement in poverty.” Too much was left for employees to figure out on their own, she said.

Caryl Zenker, 63 years old, a consultant who joined Rose City in 2022, said the benefits package, including the 401(k) plan, was one attraction. She didn’t realize she had been automatically enrolled.

Thanks to the automatic savings rate, Zenker said, she was able to capture the company’s 4% matching contribution immediately after becoming eligible for the plan. She now saves 14%, including the match.

Write to Anne Tergesen at anne.tergesen@wsj.com

Dow Jones & Company, Inc.